knoxville tn sales tax rate 2020

City Property Tax Rate. Call 865 215-2385 with further questions.

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Tennessee has a 7 sales tax and Knox County collects an additional 275 so the minimum sales tax rate in Knox County is 975 not including any city or special district taxes.

. Please click on the links to the left for more information. This is the total of state. What is the sales tax rate in Knoxville Tennessee.

Local collection fee is 1. You can print a 925 sales tax table here. Knoxville TN 37902.

212 per 100 assessed value. County Property Tax Rate. 24638 per 100 assessed value.

Johnson City 423 854-5321. City of Knoxville Revenue Office. The 2020 model gets an impressive 14MPG in the city and 23MPG on the highway.

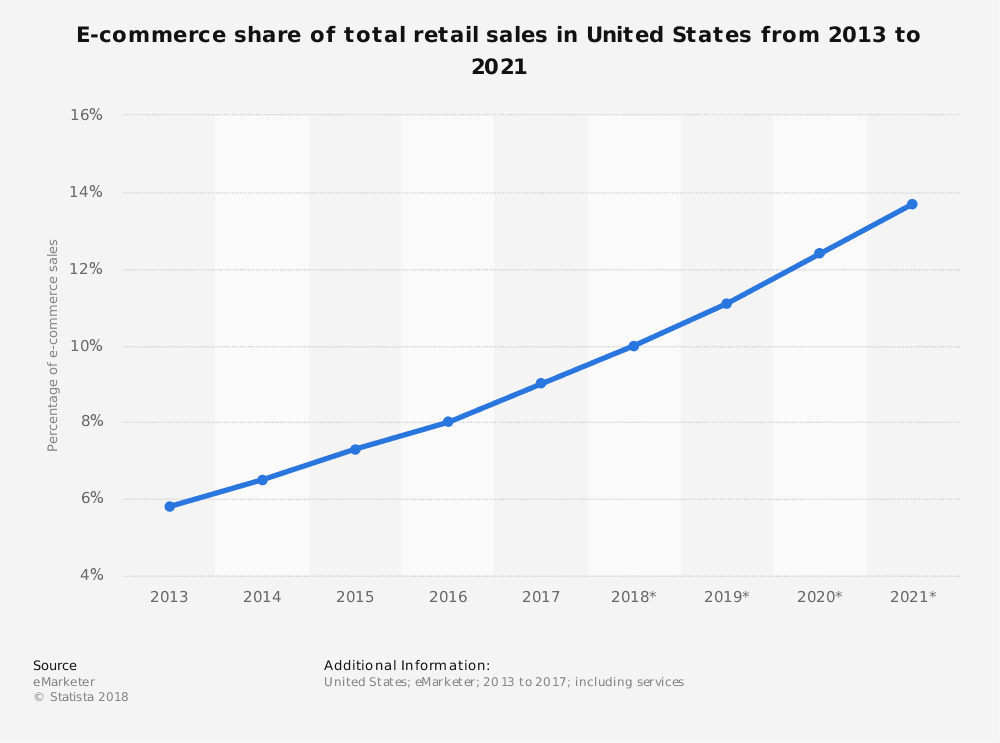

The 2018 United States Supreme Court decision in South Dakota v. Property tax rates. State Sales Tax is 7 of purchase price less total value of trade in.

The Knoxville sales tax rate is. The Tennessee state sales tax rate is currently. The Knox County Sales Tax is collected by the merchant on all qualifying sales made within Knox County.

The minimum combined 2022 sales tax rate for Knox County Tennessee is. Monday - Friday 800 am - 430 pm More Information. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945.

Please click on the links to the left for more information about tax rates registration and filing. The sales tax is comprised of two parts a state portion and a local portion. Last item for navigation.

The latest sales tax rates for cities in Tennessee TN state. Knoxville TN Sales Tax Rate. The local tax rate varies by county andor city.

The County sales tax rate is. The Tennessee sales tax rate is 7 as of 2022 with some cities and counties adding a local sales tax on top of the TN state sales tax. The Knox County Tennessee sales tax is 925 consisting of 700 Tennessee state sales tax and 225 Knox County local sales taxesThe local sales tax consists of a 225 county sales tax.

TN Sales Tax Rate. There is no applicable city tax or special tax. The minimum combined 2022 sales tax rate for Knoxville Illinois is.

The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and 225 Knox County sales tax. Wayfair Inc affect Tennessee. 2020 rates included for use while preparing your income tax deduction.

The Alabama sales tax rate is currently. The Tennessee sales tax rate is 7 as of 2022 with some cities and counties adding a local sales tax on top of the TN state sales tax. This table shows the total sales tax rates for all cities and towns in Knox County including all local taxes.

The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections. Did South Dakota v. Knox County collects a 225 local sales tax the maximum local sales tax.

The Knox County sales tax rate is. Tennessee Sales and Use Tax County and City Local Tax Rates County City Local Tax Rate Effective Date Situs FIPS Code County City Local Tax Rate Effective Date Situs FIPS Code Anderson 275. The minimum combined 2022 sales tax rate for Knoxville Tennessee is.

This is the total of state county and city sales tax rates. County and city taxes. Knoxville TN 37918 Phone.

La Vergne TN Sales Tax Rate. Sales Tax Calculator Sales Tax Table. The Tennessee sales tax rate is currently.

This is the total of state and county sales tax rates. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. 05 lower than the maximum sales tax in TN.

For tax rates in other cities see Tennessee sales taxes by city and county. 31 rows The state sales tax rate in Tennessee is 7000. Local collection fee is 1.

The general state tax rate is 7. Standard fees and sales tax rates are listed below. The Knoxville sales tax rate is.

City Property Tax Search Pay Online. Tax Sale 10 Properties PDF Summary of Tax Sale Process and General Information Tax sale dates are determined by court proceedings and will be listed accordingly. And prepared food including restaurant meals and some premade supermarket items are charged at a.

This table shows the total sales tax rates for all cities and towns in Knox County including all local taxes. What is the sales tax rate in Knox County. Tennessee has state sales tax of 7 and allows local governments to collect a local option sales tax of up to 275.

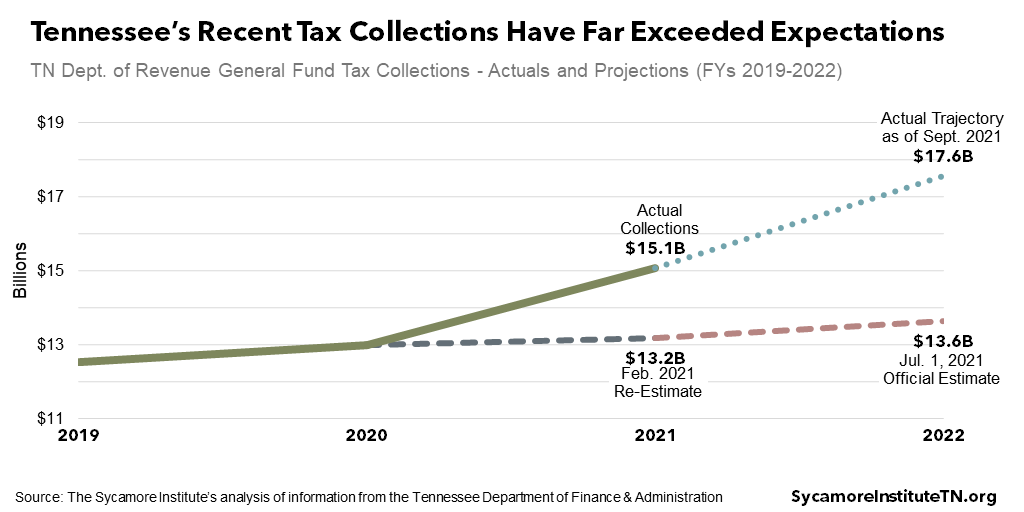

Tennessee May Have An Extra 3 Billion To Budget Next Year

Tennessee Sales Tax Rates By City County 2022

Traditional Finances City Of Conroe

Tennessee Car Sales Tax Everything You Need To Know

Tennessee Income Tax Calculator Smartasset

Historical Tennessee Tax Policy Information Ballotpedia

Tennessee Taxes Do Residents Pay Income Tax H R Block

Iowa Sales Tax Rates By City County 2022

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

3 Things You Need To Know About Internet Sales Tax After Wayfair Red Stag Fulfillment

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Traditional Finances City Of Conroe

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Arkansas Sales Tax Rates By City County 2022

Tennessee Sales Tax And Other Fees Motor Vehicle County Clerk Knox County Tennessee Government

Maintaining Merriam City Of Merriam