8915-e tax form release date

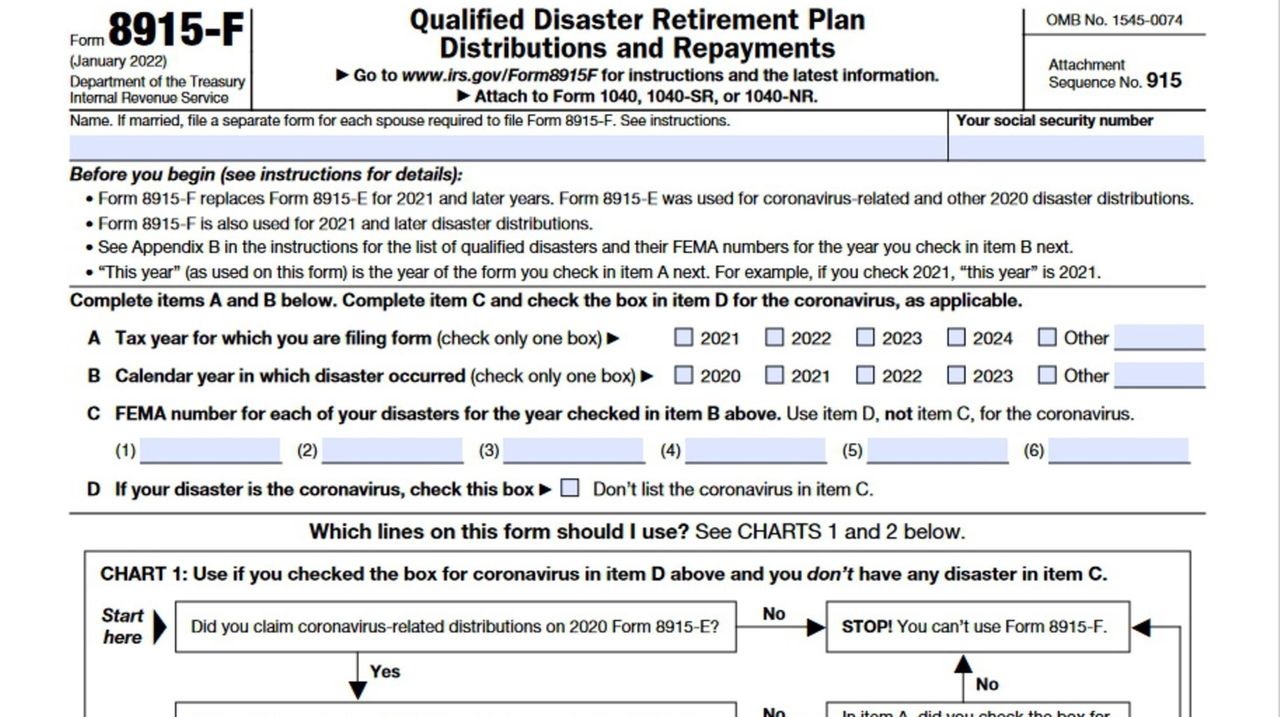

Form 8915-F is used in 2021 and 2022 to report the 13 taxable portion for those. If married file a separate form for each spouse required to file Form 8915-F.

Form 8915 E For Retirement Plans H R Block

You take your HRBlock Tax software on a thumb drive ready to be efiled except for form 8915-F to their office and the agent there adds form 8915-F to your software and then efile it to IRS your State.

. In this post you can learn more about Form 8915-E including qualified disaster distribution details instructions for Form 8915-E and how to get help completing the form. From within your TaxAct return Online or Desktop click FederalOn smaller devices click in the upper left-hand corner then click Federal. Fill in Your Address Only if You Are Filing This Form by Itself and Not With Your Tax Return.

Instructions for Form 8915-E Qualified 2020 Disaster Retirement Plan Distributions and Repayments Use for Coronavirus-Related Distributions 2020 02112021. When will the 2021 8915-f form be available on Turbo Tax to efile. Back to your 2020 Form 8915-E if you filed 2020 Form 8915-E and are eligible to amend your 2020 return.

To enter or review Form 8915-E information. The taxpayer took a retirement distribution in 2020 and elected to spread over 3 years using Form 8915-E. The relief allows taxpayers to access retirement savings earlier than they normally would be able to.

I posted the links to the IRS released forms and to the. Traditional sep simple or roth. The form is referred to using the tax year and disaster year checkedeg a 2021 Form 8915-F 2020 disasters would be a form filed for the 2021 tax year that relates to disasters that occurred in 2020.

Form 8915-E was used for coronavirus-related and other 2020 disaster distributions. To view the Forms Release Status click one of the links below. Existing Feature Vote now if this is a good idea.

With those relief measures the IRS released Form 8915-E. I documented it here. Qualified 2017 Disaster Retirement Plan Distributions and Repayments 2021 02032022 Inst 8915-B.

The 8915-E is available in the TY20 program only. CCH ProSystem fx Tax. Attach to 2020 Form 1040 1040-SR or 1040-NR.

Your social security number. Click Retirement Plan Income in the Federal Quick Q. Tax Form 8915-e Release Date Turbotax By - September 6 2021 0 A crd is a distribution taken by a qualified individual from january 1 2020 through to december 30 2020 from an ira or employer plan such as a 401 k.

Find more ideas labeled with Individual Share Thanks for your idea. Qualified 2020 Disaster Retirement Plan Distributions and Repayments 2020 Inst 8915-E. Do not use a Form 8915-F to report qualified 2020 disaster distributions made in 2020 or qualified distributions received in 2020 for 2020 disasters.

See Coronavirus-related distributions under Qualified 2020 Disaster Distribution Requirements later. Instructions for Form 8915B Qualified 2017 Disaster Retirement Plan Distributions and Repayments 2021 02042022 Form 8915-C. Installment Payments of Tax.

This form replaces Form 8915-E for tax years beginning after 2020. Form 8915-F would be available on 225 for E-filing and with tax pros____ So how does this work. Made or received in 2020.

The 8915-F is scheduled for release on 33122. CCH Axcess Tax - Forms Release Status. In this Tax Talk topic.

The Form 8915-E 2020 Disasters is replaced with -F forever form for tax year 2021 filing. Your social security number Before you begin see instructions for details. Click Taxpayer Qualified 2020 disaster retirement plan distributions and repayments Form 8915-E.

Yoga Release forms Luxury Free Damage Waiver Template. Instructions for Form 8915-E Qualified 2020 Disaster Retirement Plan Distributions and Repayments Use for Coronavirus-Related Distributions 2020. A distribution made December 31.

If you were impacted by the coronavirus and you made withdrawals from your retirement plan in 2020 before December 31 you may have coronavirus-related distributions eligible for special tax benefits on Form 8915-E. The forms release status web page shows when the new years forms will be available or were released to file. Individual Income Tax Return.

Form 8915-F replaces Form 8915-E for 2021 and later years. In Tax Preparation click Forms Status on the menu bar. Form 1040-SR and Schedules 1 - 3.

CCH ProSystem fx Tax - Forms Release Status. Since 8915-F is a multi-year form preparer must indicate the year for which the form is applicable Form 8915-F must be filed if either of the following apply. You will still use 2020 Form 8915-E to report coronavirus-related and other qualified disaster distributions.

Ad Register and Subscribe Now to work on your IRS 8915-E Form more fillable forms. If married file a separate form for each spouse required to file 2020 Form 8915-E. Revision Date Posted Date.

The other has all of the 8915 forms as 3172022. I know that the irs website does not have an actual date for when this will be released but I have read in a few posts in a tax refund group on Facebook that HR Block is telling their customers it. We need a Professional edition release date for form 8915-E for 2020 coronavirus related distributions spread over 3 years.

Alternative Filing Method for E-filed Returns That Include Form 8915-E-- 08-FEB-2021. On your 2020 Form 8915-E you reported a coronavirus-related distribution of 9000 made to you from your traditional IRA on April 14 2020. US Tax Return for Seniors.

Application for Employer Identification Number.

8915 E Form Fill Online Printable Fillable Blank Pdffiller

Solved Wil The Amount Of The 3 Year Covid Annuity Repayme Intuit Accountants Community